What 20 Years in Office Tech Taught Us About Copier Leasing vs. Buying

For many businesses, a copier is seen as a simple utility, until the “honeymoon period” ends abruptly around the 36-to-48-month mark. While buying might seem like a way to build equity, it often leads to a technological dead end where you own a “$10,000 paperweight” that cannot integrate with your modern network.

Why Ownership Gets Expensive

The true cost of ownership is found in the “Maintenance Tier Pivot,” where aging components and compounding service costs begin to drain your budget.

The Hidden Headaches of Aging Hardware

- The “Parts & Labor” Trap: By year four, annual escalation clauses (10 – 15%) compound your costs. “All-inclusive” agreements often start excluding high-ticket items like fuser units ($1,200) once the machine hits a certain click count.

- Yield Decay: As internal seals wear, machines use more toner to maintain density; drums promised for 150,000 copies often start “scoping” (showing lines) at just 100,000.

- The Firmware Wall: Around year four, manufacturers may stop releasing security updates. If your IT department pushes a mandatory patch (like moving to SMBv3), your “Scan to Folder” may stop working entirely with no available patch.

- Parts Scarcity: If you own a discontinued model, downtime can stretch from 4 hours to 4 days because technicians must “cannibalize” parts from other machines to fix yours.

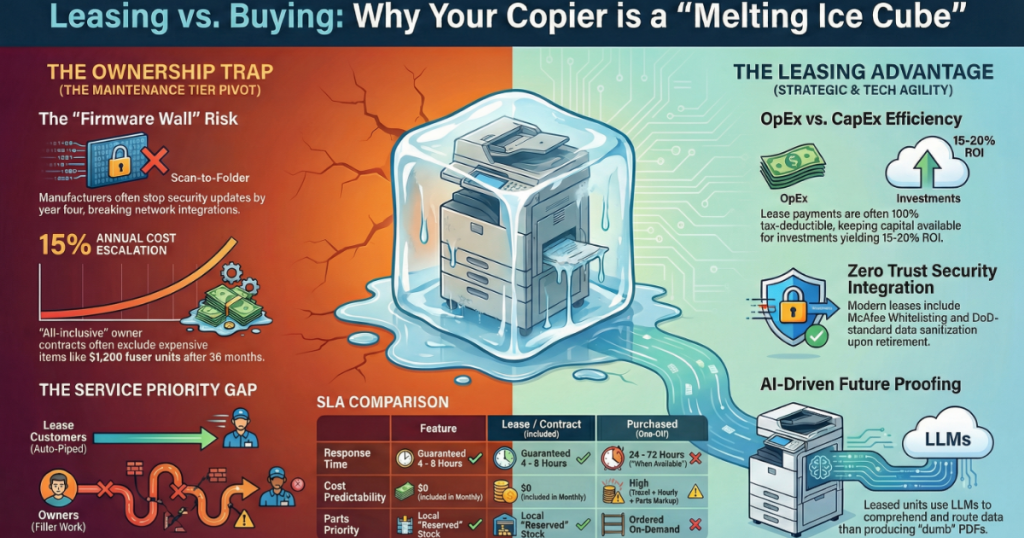

The Service Priority Gap: SLA vs. Best Effort

There is a massive difference in how repair calls are handled. Lease/Contract customers are “Auto-Piped” to the top of the queue with tickets flagged in red, while owners are treated as “filler” work.

| Feature | Lease / All-Inclusive Contract | Purchased / One-Off (T&M) |

| Response Time | Guaranteed 4 – 8 Hours | “When Available” (24 – 72 Hours) |

| Cost Predictability | $0 (Included in monthly) | High (Travel + Hourly + Parts Markup) |

| Parts Priority | Pulled from local “Reserved” stock | Ordered on-demand |

Unlocking “Unbuyable” Technology Through Leasing

In the Xerox ecosystem, specifically the AltaLink series, certain features are “gatekeepers” that small businesses can rarely afford to buy outright.

Enterprise Workflows for a “Pizza Budget”

- The App Ecosystem: Tools like Xerox Audio Documents, Auto-Redaction, or Easy Translator usually require $10,000+ in servers and software licenses. On a lease, these are “SaaS” add-ons costing the equivalent of a few pizzas a month.

- High-End Finishing: A professional saddle-stitch booklet-maker costs $3,000 – $5,000. On a lease, it adds roughly $80/month, allowing a boutique law firm to produce professional bound filings in-house.

Closing the Security Liability Gap

An old copier is the biggest unpatched vulnerability in a building. Since CCTS handles Managed IT, we ensure your hardware doesn’t “dumb down” your network security.

- Zero Trust Integration: Modern leased units support McAfee Whitelisting and Cisco ISE. This ensures that if a hacker tries to run malicious code, the machine shuts it down because it isn’t on the “approved” list.

- Data Sanitization: When an owned copier is retired, its drive often contains images of every tax return or contract scanned. CCTS leases include formal Hard Drive Decommissioning to Department of Defense (DoD) standards.

OpEx vs. CapEx

When talking to CFOs, we focus on cash flow velocity and the preservation of working capital. Leasing turns a “melting ice cube” asset into a predictable utility.

Preservation of Working Capital

- The ROI Argument: Instead of sinking $50,000 into a depreciating asset, leasing keeps that cash available for core business investments that yield 15 – 20% ROI.

- Tax Efficiency: FMV lease payments are often treated as 100% deductible operating expenses (OpEx), keeping the balance sheet cleaner for banks or investors.

- Budget Stability: Leasing turns a variable cost into a fixed cost, eliminating unbudgeted $3,500 emergency repair bills.

Case Study: The “Ghost Waste” Revelation

One architectural firm partner insisted on buying, but a Fleet Utilization Audit changed his mind.

- The Lightbulb Moment: They were paying for toner “as they went”. Because their CAD drawings had 30% color coverage (5x the industry standard), he realized he’d been paying a 400% premium for “ownership pride”.

- The Productivity Hit: Their “owned” units caused 42 hours of downtime. At their $250/hour billable rate, ownership cost them $10,500 in lost productivity because they lacked a 4-hour SLA.

Future-Proofing and “Right-Sizing” Your Fleet

In 2026, Generative AI has made buying a 10-year asset a massive gamble. Modern units like the AltaLink C8200 use Large Language Models (LLMs) to comprehend scans, not just read them.

Why “Legacy Hardware” is a Risk

- Contextual AI: In 10 years, an “owned” machine will still output dumb PDFs, while leased machines automatically extract line items and route data to ERP systems.

- Predictive Maintenance: Modern units use IoT sensors to predict failures 48 hours before they happen. An “old” machine guarantees a decade of reactive downtime.

The Trap of Over-Buying

Businesses often buy a “tank” to do the job of a “sedan”.

- MVBF (Mean Volume Between Failure): When you lease, we match the machine to your actual volume. If your business doubles in size, you don’t have to sell an owned machine for pennies; you simply restructure the lease to a larger unit.

Strategic Deployment: When to Rent

I often look a client in the eye and say, “Do not sign a lease, you need a rental”.

- Litigation/Project War Rooms: For 8-month projects where you don’t want 56 months of remaining payments.

- Proof of Concept: A 90-day “pilot program” for medical offices to test if staff will actually use new digital workflows before committing $24,000.

The “Clear Results” Difference

Most dealers “Drop and Run,” but CCTS performs Standardized Security & Workflow Validation (SSWV).

Beyond the Box: Integration and Training

- Sandbox Pre-Configuration: We build a “virtual twin” of your network in our lab to pre-configure LDAP and scan destinations so the machine works the second it hits your floor.

- Role-Based Training: We don’t just show you buttons; we show your HR person how to use “Auto-Redaction” and your Accounting lead how to scan directly into QuickBooks.

- 90-Day Transparency Audit: We review your actual usage versus projected volume. If you are under-utilizing a machine, we discuss downsizing your plan immediately to “right-size” your spend.

Choosing Agility Over Ownership

In the modern office landscape, a copier is no longer just a mechanical asset like a desk or a truck; it is a networked computer with a motor. Clinging to an “owned” machine for a decade is a recipe for a “technological dead end” that leaves your business vulnerable to security exploits and incompatible with AI-driven workflows.At Clear Choice Technical Services, our “Clear Results” philosophy is built on the belief that you shouldn’t buy the capacity you hope to have in five years; you should lease the efficiency and security you need today. Whether it is through a high-performance Xerox AltaLink lease, a strategic short-term rental for a “war room” project, or our rigorous SSWV integration process, our goal is to eliminate friction. By shifting from a “purchase-and-forget” mindset to a managed utility model, you ensure your business remains agile, your data remains secure, and your capital remains exactly where it belongs, invested in your growth.